Morgan Stanley’s Institute for Sustainable Investing has published important new findings comparing the performance of sustainability and mainstream funds.

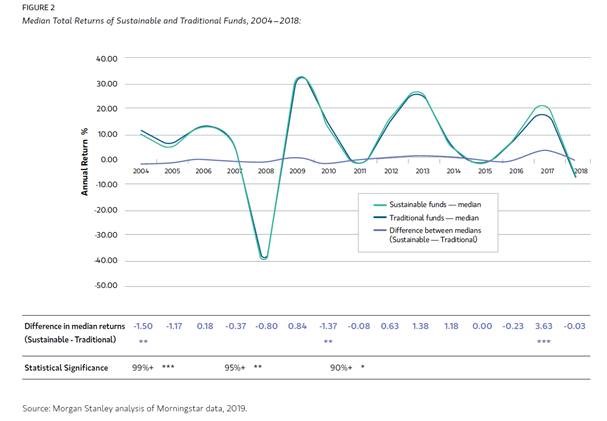

Over the last 14 years sustainability funds have performed similarly to mainstream funds, with no statistically significant difference in total returns.

The study also showed that sustainability funds have lower risk than mainstream funds and outperform in periods of volatility.

Here is a link to the full paper: Sustainable Reality: Analyzing Risk and Returns of Sustainable Funds

Others are finding similar results where companies or funds are also considering the environment, society and corporate governance (ESG)...

“higher ESG-rated companies mildly outperformed those with lower ratings”

MSCI 2018, ‘Foundations of ESG Investing – Part 1’

“Strong ESG performance contributes to risk mitigation, as well as being an indicator of strong operational and share price performance.”

Nordea 2017, ‘Cracking the ESG Code

“Who Cares Wins”

UN Global Compact, 2004

You can read research showing positive ESG performance here:

AQR 2017, ‘Assessing Risk Through Environmental Social and Governance Exposures’

Nordea 2017, ‘Cracking the ESG Code’

JP Morgan 2016, ‘A Quantitative Perspective of how ESG can Enhance your Portfolio’

Barclays 2016, ‘The positive impact of ESG investing on bond performance’

Credit Suisse 2015, ‘Finding Alpha in ESG’

MSCI 2015, 'Can ESG Add Alpha'

Harvard Business School 2015, ‘Corporate Sustainability: First Evidence on Materiality’

Journal of Sustainable Finance and Investment 2015, ‘ESG and financial performance: aggregated evidence from more than 2000 empirical studies’

Journal of Business Ethics 2015, ‘The Opportunity Cost of Negative Screening in Socially Responsible Investing’

Deutsche Bank 2013, ‘The Socially Responsible Quant’